Cass Information Systems, Inc. Reports Continuing Earnings Recovery

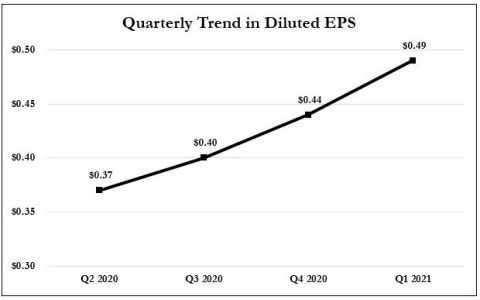

Q1 2021 Marks 3rd Consecutive Quarter With Higher Earnings; Up 32% from Pandemic-Induced Low

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210422005184/en/

Earnings Recovery Continues at

Net income for the period was

When compared to the first quarter of 2020, which largely transpired prior to the full impact of the pandemic, diluted earnings per share declined 5.8%. Key volume and financial data comparing quarters is as follows:

|

|

|

|

%

|

|

Transportation Invoice Volume |

8.8 million |

8.3 million |

6.1 |

|

Transportation Dollar Volume |

|

|

22.2 |

|

Facility Expense Transaction Volume* |

7.0 million |

6.5 million |

7.5 |

|

Facility Expense Dollar Volume* |

|

|

7.5 |

|

Revenues |

|

|

(2.7) |

|

Net Income |

|

|

(6.3) |

|

Diluted Earnings Per Share |

|

|

(5.8) |

*Includes Energy, Telecom and Waste

Transportation invoice and dollar volumes improved 6.1% and 22.2%, respectively. Fueling the increases were the stronger performance of the manufacturing sector quarter over quarter and new customer wins over the past 12 months. Further improvement in dollar volume resulted from scarcity in carrier supply, which drove prices higher.

Facility-related (electricity, gas, waste and telecom expense management) invoice and dollar volumes both increased 7.5% with the increases attributable, in part, to new business wins.

Revenues declined 2.7% quarter over quarter as a result of a decrease in gains on the sale of securities of

Consolidated operating expenses decreased

“Despite the pandemic and historically low interest rates, Cass has been able to steadily grow its customer base, revenue and earnings since the second quarter of 2020,” noted

Cash Dividend Declared

On

About

Note to Investors

Certain matters set forth in this news release may contain forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results to differ materially from those in such statements. These risks and uncertainties include the scope, duration and ultimate impact of the COVID-19 pandemic as well as economic and market conditions, risks of credit deterioration, interest rate changes, governmental actions, market volatility, security breaches and technology interruptions, energy prices and competitive factors, among others, as set forth in the Company's most recent Annual Report on Form 10-K and subsequent reports filed with the

Selected Consolidated Financial Data

The following table presents selected unaudited consolidated financial data (in thousands, except per share data) for the periods ended

|

|

|

Quarter

|

|

Quarter

|

|

|||

|

Transportation Invoice Volume |

|

8,787 |

|

|

8,280 |

|

||

|

Transportation Dollar Volume |

$ |

7,904,639 |

|

$ |

6,467,051 |

|

||

|

Facility Expense Transaction Volume |

|

6,996 |

|

|

6,509 |

|

||

|

Facility Expense Dollar Volume |

$ |

3,717,428 |

|

$ |

3,458,646 |

|

||

|

|

|

|

|

|

|

|

||

|

Payment and Processing Fees |

$ |

25,216 |

|

$ |

25,503 |

|

||

|

Net Interest Income |

|

10,345 |

|

|

11,373 |

|

||

|

(Release of) Provision for Credit Losses |

|

(600) |

|

|

325 |

|

||

|

Gains on Sales of Securities |

|

48 |

|

|

1,069 |

|

||

|

Other |

|

911 |

|

|

523 |

|

||

|

Total Revenues |

$ |

37,120 |

|

$ |

38,143 |

|

||

|

Personnel |

$ |

22,526 |

|

$ |

22,427 |

|

||

|

Occupancy |

|

947 |

|

|

941 |

|

||

|

Equipment |

|

1,675 |

|

|

1,635 |

|

||

|

Other |

|

3,377 |

|

|

3,926 |

|

||

|

Total Operating Expenses |

$ |

28,525 |

|

$ |

28,929 |

|

||

|

Income from Operations before Income Tax Expense |

$ |

8,595 |

|

$ |

9,214 |

|

||

|

Income Tax Expense |

|

1,524 |

|

|

1,669 |

|

||

|

Net Income |

$ |

7,071 |

|

$ |

7,545 |

|

||

|

Basic Earnings per Share |

$ |

.49 |

|

$ |

.52 |

|

||

|

Diluted Earnings per Share |

$ |

.49 |

|

$ |

.52 |

|

||

|

|

|

|

|

|

|

|

||

|

Average Earning Assets |

$ |

1,891,395 |

|

$ |

1,487,873 |

|

||

|

Net Interest Margin |

|

2.32% |

|

|

3.21% |

|

||

|

Allowance for Credit Losses to Loans / Allowance for Loan Losses to Loans |

|

1.32% |

|

|

1.27% |

|

||

|

Non-performing Loans to Total Loans |

|

— |

|

|

— |

|

||

|

|

|

— |

|

|

— |

|

||

View source version on businesswire.com: https://www.businesswire.com/news/home/20210422005184/en/

Source: